S&P 500 Index Explained: Companies, Weighting, and Selection Criteria

A Simple Guide to How the S&P 500 Works, Which Companies Are Included, and Why It Matters for Investors

The S&P 500 companies list is one of the most searched topics by people who want to understand how the U.S. stock market works. If you have ever heard the term s&p 500, you may wonder what it really means and why it matters so much.

In simple words, the s&p 500 is a group of 500 large companies in the United States. These companies represent many industries and give a clear picture of how the overall market is performing.

In this guide, you will learn how the s&p 500 works, how companies are chosen, and why investors follow it closely.

What Is the S&P 500?

The s&p 500 is a stock market index. An index is a list that tracks the performance of selected companies.

It includes 500 of the biggest publicly traded companies in the U.S. When these companies do well, the index usually rises. When they struggle, the index often falls.

Many people use the s&p 500 to measure the health of the U.S. economy. If the index is growing over time, it often means businesses are growing too.

Why the Index Matters to Investors?

The s&p 500 is important because it shows how large companies are performing. It covers about 80% of the total U.S. stock market value.

For example, if you invest in a fund that tracks the s&p 500, your money is spread across many companies. This reduces risk compared to buying just one stock.

It is also used as a benchmark. Investors compare their returns to the index to see if they are doing better or worse.

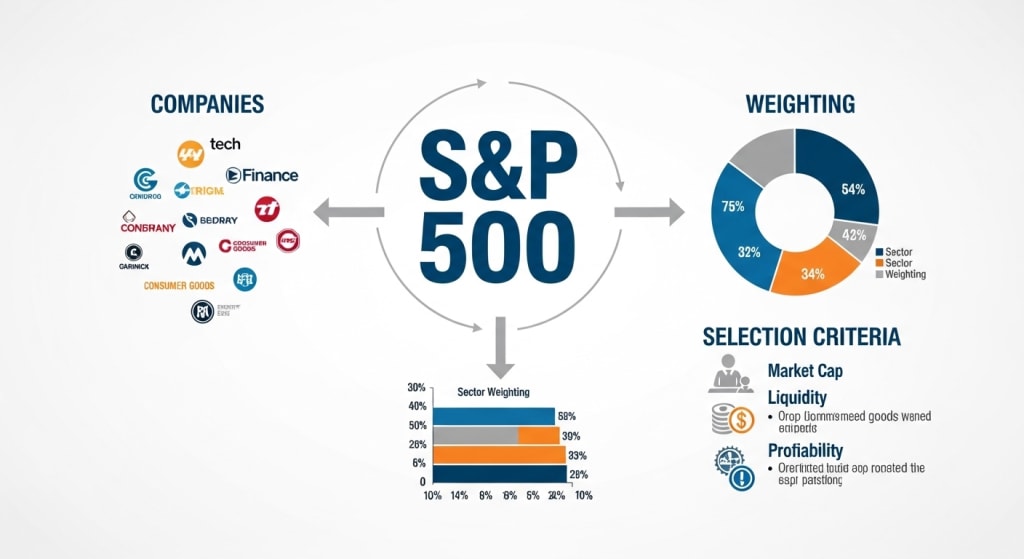

A Look at the S&P 500 Companies List

The S&P 500 companies list includes well-known names from different industries. These companies are leaders in their fields.

Some examples include:

Technology companies like Apple and Microsoft

Healthcare firms like Johnson & Johnson

Financial companies like JPMorgan Chase

Retail giants like Walmart

Energy companies like ExxonMobil

The s&p 500 is not limited to one sector. It spreads across areas such as technology, health, finance, energy, and consumer goods.

This mix helps the index stay balanced. If one sector falls, another may rise and soften the impact.

How Companies Are Selected?

Not every company can join the s&p 500. There are clear rules for selection.

Here are the main requirements:

The company must be based in the United States

It must be listed on a major U.S. stock exchange

It must have a large market value

It must show positive earnings

Its shares must be easy to trade

A special committee reviews companies regularly. They decide which firms should be added or removed from the s&p 500.

This keeps the index up to date and relevant.

Market Capitalization

Market capitalization means the total value of a company’s shares. It is calculated by multiplying the stock price by the number of shares available.

The s&p 500 focuses on large-cap companies. These are companies worth billions of dollars.

For example, if a company has 1 billion shares and each share costs $100, its market value is $100 billion. Large companies like this often qualify for the index.

Because of this focus, the s&p 500 represents stable and established businesses.

How Weighting Works in the Index?

The s&p 500 uses market-cap weighting. This means bigger companies have more influence on the index.

If a large company’s stock price moves, it affects the index more than a smaller company’s movement.

For example:

A major tech company with a huge value can move the index noticeably.

A smaller company in the list will have a smaller impact.

This system reflects real market conditions. Larger companies naturally play a bigger role in the economy.

Sector Breakdown and Diversity

The s&p 500 is divided into sectors. Each sector represents a part of the economy.

Main sectors include:

Information Technology

Healthcare

Financials

Consumer Discretionary

Industrials

Energy

Utilities

Real Estate

Communication Services

Consumer Staples

Materials

This wide coverage makes the s&p 500 a strong indicator of overall market trends. It shows how different parts of the economy are performing at the same time.

How Often the Index Changes?

The s&p 500 is not a fixed list forever. Companies can be added or removed.

If a company no longer meets the rules, it may be replaced. For example, if a business shrinks or faces financial trouble, it could be taken out.

New fast-growing companies may also be added. This keeps the index fresh and aligned with today’s economy.

Changes are not made daily. They happen only when necessary.

How to Invest in the Index?

You cannot invest directly in the s&p 500 itself. But you can invest in funds that track it.

Common options include:

Index mutual funds

Exchange-traded funds (ETFs)

Retirement accounts that follow the index

These funds aim to copy the performance of the s&p 500. When the index rises, your investment may grow too.

Many beginners choose this method because it is simple and diversified.

Benefits and Risks to Consider

Like any investment, the s&p 500 has both benefits and risks.

Benefits:

Broad market exposure

Lower risk than single stocks

Long-term growth potential

Easy access through funds

Risks:

Market downturns can lower value

Lzrge companies dominate returns

Economic crises affect performance

For example, during financial crises, the s&p 500 has dropped sharply. However, over long periods, it has shown steady growth.

This makes it popular for long-term investors.

Historical Performance Over Time

The s&p 500 has a long history of growth. Over decades, it has delivered average annual returns of around 8% to 10%, though returns vary year by year.

There have been big drops, such as during recessions. Yet the index has recovered each time.

This pattern shows why many people trust the s&p 500 for long-term investing. Patience often rewards investors.

How It Reflects the U.S. Economy?

The s&p 500 is often seen as a mirror of the U.S. economy. When businesses expand, hire workers, and increase profits, the index usually rises.

When economic problems appear, stock prices may fall. This close link makes the index a key tool for analysts and news reports.

However, it mainly represents large companies. Small businesses are not directly included.

Final Thoughts

The s&p 500 is more than just a number on the news. It is a carefully selected group of 500 leading U.S. companies that show how the market and economy are performing.

We explored how companies are selected, how weighting works, and why sector balance matters. We also looked at the role of the S&P 500 companies list and how investors can use it to build diversified portfolios.

If you are thinking about investing, understanding the s&p 500 is a smart first step. Study the index, review your goals, and consider long-term strategies before making decisions.

By learning how the s&p 500 works, you gain a clearer view of the market and a stronger base for financial growth.

Comments

There are no comments for this story

Be the first to respond and start the conversation.