bitcoin

Behold the Bitcoin, the original cryptocurrency; whether you're a skeptic or a bitcoin believer, get the lowdown on this controversial coin.

Multi-Chain Stablecoin Adoption: The Future of On-Chain Liquidity

The rapid evolution of blockchain ecosystems has fundamentally altered how liquidity is created, distributed, and sustained across decentralized networks. As decentralized finance matures, the limitations of single-chain asset deployment are becoming increasingly apparent. This shift has accelerated interest in the Multi-Chain Stablecoin model, which enables value transfer, settlement, and liquidity provisioning across multiple blockchain environments without compromising price stability.

By Siddarth Dabout 4 hours ago in The Chain

MiCA and Stablecoins in 2026: How Europe Is Redefining Peg Stability and Reserves

In 2026, MiCA and Stablecoins remain at the forefront of financial regulatory evolution. The European Union’s Markets in Crypto-Assets Regulation (MiCA) has fundamentally reshaped how electronic money tokens (EMTs) and stable value instruments operate within the Single Market. With mounting institutional adoption and escalating macroeconomic pressures, MiCA’s explicit norms on reserve composition, collateral buffers, and peg reliability are critical for market integrity. This analysis explores MiCA’s architecture, the mechanics governing reserve adequacy, and the implications for innovation and compliance in the European digital asset ecosystem.

By Siddarth Da day ago in The Chain

Understanding the CLARITY Act on Stablecoin: A Regulatory Turning Point

The rapid adoption of digital currencies has redefined global financial infrastructure, with stablecoins emerging as a key bridge between traditional finance and blockchain-based ecosystems. Within this context, the CLARITY Act on stablecoin has gained significant traction among policymakers, regulators, and industry stakeholders. This legislative initiative represents a watershed moment in the effort to impose a coherent regulatory framework on stablecoins — digital assets engineered to maintain price stability relative to a reference asset such as a sovereign currency.

By Siddarth D7 days ago in The Chain

Decentralized Stablecoin and the Quiet Reinvention of Digital Money

For years, the promise of cryptocurrency has been financial freedom—borderless, permissionless, and independent of centralized institutions. Yet volatility has remained the biggest barrier to real-world adoption. It is difficult to treat an asset as money when its value fluctuates dramatically within hours. This is where the decentralized stablecoin enters the conversation, not as a loud disruptor, but as a quiet reinvention of how digital money can function.

By Siddarth D7 days ago in The Chain

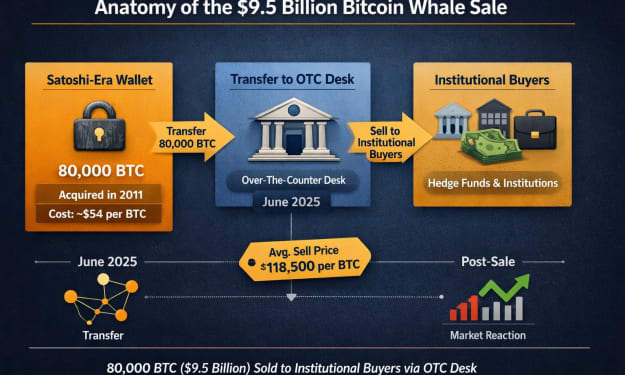

Bitcoin Whale $9.5 Billion Crypto Sale: Market Impact & What Traders Must Know

Anatomy of the Transaction In mid-2025, the cryptocurrency world was rocked by an unprecedented event: a bitcoin whale moved over 80,000 BTC, worth approximately $9.5 billion. This enormous transaction, coming from a wallet believed to be from the early days of Bitcoin, quickly grabbed the attention of the global financial community. The sale wasn’t just a typical market order. Instead, it was strategically executed, likely through over-the-counter (OTC) desks, which are used by large players to minimize market disruption. This is important because whale movements can often cause price volatility if not managed carefully.

By saif ullah12 days ago in The Chain

GENIUS Act Impact on Stablecoins: A Regulatory Shift in Digital Finance

The evolution of digital finance has brought about a surge in innovative financial instruments, with stablecoins emerging as a critical bridge between traditional currencies and blockchain ecosystems. However, the rapidly growing market has also attracted regulatory attention, prompting legislative measures to ensure security, transparency, and financial stability. Among the most significant regulatory developments is the GENIUS Act, a proposed framework aimed at strengthening oversight of digital assets, particularly stablecoins. This article explores the implications of the GENIUS Act on stablecoins, its potential influence on stablecoin development, and what it means for businesses and investors in the digital finance sector.

By Siddarth D14 days ago in The Chain

Japan Suspends World’s Largest Nuclear Plant Hours After Restart. AI-Generated.

Japan has once again found itself at the center of a global energy debate after suspending operations at the world’s largest nuclear power plant just hours after it was restarted. The unexpected halt has reignited concerns about nuclear safety, operational readiness, and Japan’s long-term energy strategy as it balances climate goals with public trust.

By Muhammad Hassan15 days ago in The Chain

Bitcoin Rainbow Chart Explained: A Colorful Guide to Bitcoin’s Long-Term Price Cycles

Introduction The Bitcoin Rainbow Chart is one of the most iconic and widely shared visuals in the crypto world. At first glance, it looks playful and simple—just a colorful curve with price bands. But behind those bright colors lies a powerful long-term valuation model that many investors use to understand where Bitcoin may sit in its market cycle.

By saif ullah16 days ago in The Chain

Cryptocurrencies: The Looming Crypto Winter of 2026

The cryptocurrency business has always prospered under challenging circumstances. Crushing sadness followed exuberant anticipation. Dramatic crashes that come after rises that are parabolic. Every cycle humbles people who think "this time is different" and promises maturity. As the second half of the decade progresses, an increasing number of indicators suggest an unsettling reality that many in the cryptocurrency industry are unwilling to face: a crypto winter in 2026 is not only conceivable, but it might well be likely. This isn't a scare tactic. Pattern recognition is what it is.

By Mark Arthur17 days ago in The Chain

Bitcoin Price Shock: How the U.S. Treasury Secretary’s Crypto Moves Unleashed Market Turmoil

Introduction Bitcoin’s price has been on a rollercoaster in recent months, but few events hit as hard or as fast as the shockwaves triggered by comments and policy signals from U.S. Treasury Secretary Scott Bessent and broader Treasury actions. What should be a relatively stable cryptocurrency at the heart of the market instead saw dramatic volatility when government rhetoric intersected with trader expectations. From surprise endorsements to strategic reserve clarification missteps and geopolitical risk aversion, Bitcoin price shocks in 2025–2026 reveal a new era where government signals matter as much as on‑chain data and macro flows.

By saif ullah18 days ago in The Chain

Bitcoin Dominance Explained: What It Is & Why It Matters for Crypto Traders

Introduction Bitcoin dominance is one of the most watched indicators in the crypto market. It shows how much of the total cryptocurrency market value belongs to Bitcoin compared to all other cryptocurrencies combined. Traders, long-term investors, and analysts track this metric because it helps explain capital rotation, market sentiment, and risk appetite across crypto cycles.

By saif ullah20 days ago in The Chain