India Immunoglobulin Market Size and Forecast 2025–2033

Rising Demand for Life-Saving Antibody Therapies Signals a New Era for India’s Biopharma Landscape

Introduction: A Quiet Revolution in India’s Healthcare

India’s healthcare ecosystem is undergoing a powerful transformation, driven by rising disease awareness, expanding diagnostic capabilities, and a growing emphasis on advanced therapies. Among the most critical and life-saving treatment categories gaining momentum is immunoglobulin therapy—a cornerstone in the management of immunodeficiency disorders, autoimmune diseases, and several rare and chronic conditions.

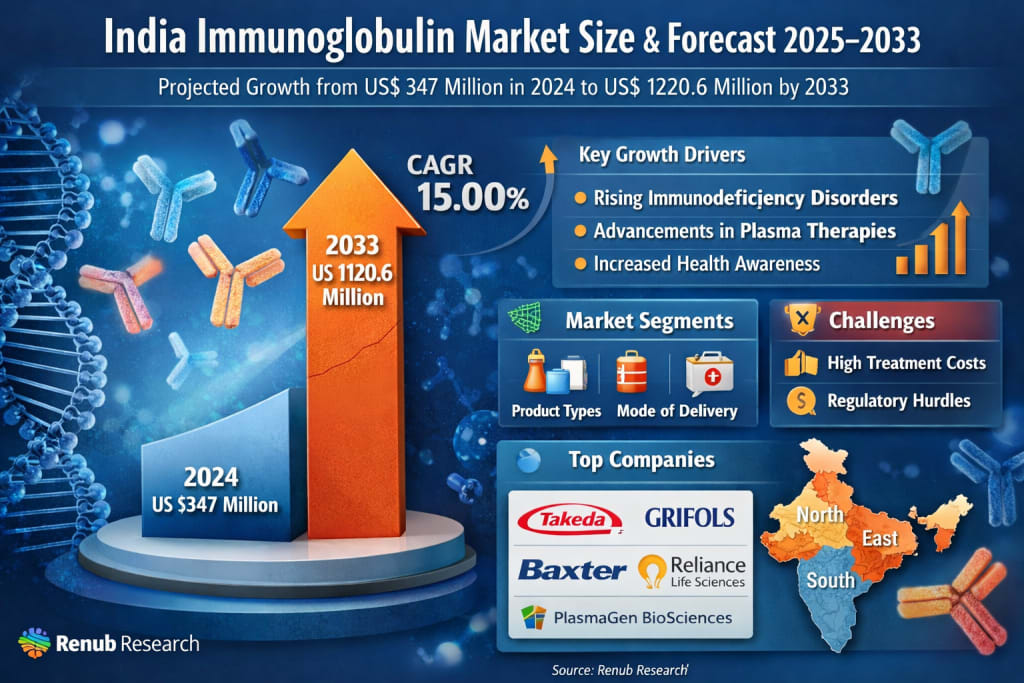

According to Renub Research’s latest industry analysis, the India Immunoglobulin Market is expected to reach US$ 1,220.6 million by 2033, up from US$ 347 million in 2024, registering a robust compound annual growth rate (CAGR) of 15.00% from 2025 to 2033. This sharp rise reflects not only the increasing medical need but also the rapid evolution of India’s biopharmaceutical manufacturing capabilities, supportive government initiatives, and improving access to specialized care.

Immunoglobulins, also known as antibodies, are essential proteins produced by the immune system to identify and neutralize harmful pathogens such as bacteria, viruses, and toxins. In clinical practice, therapeutic immunoglobulins—primarily derived from human plasma—are used to treat a wide range of conditions, including primary and secondary immunodeficiency disorders, autoimmune diseases, neurological disorders, and certain hematological conditions.

As India faces a dual burden of communicable and non-communicable diseases, the role of immunoglobulin therapy is becoming increasingly central to modern treatment protocols. The market’s growth story is therefore not just about numbers—it is about saving lives, improving quality of care, and strengthening the country’s healthcare infrastructure.

Understanding Immunoglobulins: The Backbone of Immune Defense

Immunoglobulins are specialized glycoproteins produced by B cells and plasma cells in the human body. Their primary role is to recognize specific antigens and trigger immune responses that help eliminate pathogens. There are five major classes of immunoglobulins—IgG, IgA, IgM, IgE, and IgD—each serving a distinct biological function.

IgG is the most abundant and is widely used in therapeutic formulations due to its broad protective role against infections.

IgA plays a crucial role in mucosal immunity, especially in the respiratory and gastrointestinal tracts.

IgM is often the first antibody produced in response to an infection.

IgE is associated with allergic responses and parasitic infections.

IgD, though less understood, is involved in immune system regulation.

Therapeutic immunoglobulins, typically administered intravenously or subcutaneously, are derived from pooled human plasma and undergo rigorous purification and safety processes. These therapies are indispensable for patients whose immune systems are unable to produce sufficient antibodies on their own, as well as for those suffering from autoimmune and inflammatory disorders.

Market Overview: Why India Is Emerging as a High-Growth Hub

The Indian immunoglobulin market is expanding at a rapid pace due to a combination of medical, technological, and policy-driven factors. One of the most significant drivers is the rising prevalence of immunodeficiency and autoimmune disorders, many of which require long-term or lifelong immunoglobulin therapy.

At the same time, advancements in plasma fractionation and purification technologies have improved product quality, safety, and manufacturing efficiency. These improvements have helped increase domestic production capacity, reducing India’s reliance on imports and making therapies more accessible and affordable over time.

Government support for biotechnology and pharmaceutical manufacturing has further strengthened the ecosystem. Initiatives aimed at boosting domestic production of critical drugs, improving healthcare infrastructure, and expanding insurance coverage have played an important role in widening patient access to advanced treatments.

Additionally, growing healthcare awareness and better diagnostic capabilities are enabling earlier detection of conditions that require immunoglobulin therapy. As a result, more patients are entering treatment pathways at earlier stages of disease, driving sustained demand for these products.

Key Growth Drivers Shaping the Market

1. Rising Prevalence of Immunodeficiency Disorders

One of the most powerful forces behind the growth of the immunoglobulin market in India is the increasing recognition and diagnosis of primary immunodeficiency diseases (PIDs). PIDs are a group of more than 450 rare genetic disorders that weaken the immune system, making individuals more susceptible to recurrent infections, autoimmune conditions, and even certain cancers.

Globally, the incidence of PIDs is estimated to be between 1 in 25,000 to 1 in 50,000 live births. In India, however, the estimated incidence is significantly higher—around 1 in 10,000 live births. Despite this, awareness and diagnosis remain limited, with a large proportion of patients still undiagnosed or misdiagnosed.

As awareness improves among healthcare professionals and the general public, more patients are being correctly identified and treated. Since immunoglobulin replacement therapy is a cornerstone treatment for many PIDs, this growing patient base is directly translating into rising market demand.

2. Advancements in Plasma-Derived Therapies

Technological progress in plasma collection, fractionation, and purification has had a transformative impact on the immunoglobulin industry. Modern manufacturing processes have enhanced product safety, consistency, and yield, while also improving overall production efficiency.

These advancements have supported the expansion of domestic manufacturing in India, helping reduce dependence on imported plasma-derived products. With improved supply chains and better quality control systems, immunoglobulin therapies are becoming more widely available across the country.

This progress is particularly important in a market like India, where affordability and accessibility are critical concerns. By strengthening local production capabilities, the industry is better positioned to meet growing demand while also improving patient outcomes.

3. Increasing Healthcare Awareness and Diagnosis Rates

Another major growth driver is the steady rise in healthcare awareness and diagnostic capacity across India. Public health campaigns, medical education initiatives, and improved access to diagnostic technologies are enabling earlier and more accurate detection of immunodeficiency, autoimmune, and neurological disorders.

Early diagnosis is crucial, as timely initiation of immunoglobulin therapy can significantly improve quality of life, reduce complications, and lower long-term healthcare costs. As more patients enter the healthcare system at earlier stages of disease, the demand for immunoglobulin products continues to rise.

Government programs and private sector investments in healthcare infrastructure have further accelerated this trend, particularly in urban and semi-urban regions.

Challenges Facing the India Immunoglobulin Market

High Cost of Immunoglobulin Therapies

Despite strong growth prospects, the market faces a significant challenge in the form of high treatment costs. Immunoglobulin products are complex to manufacture, requiring strict quality controls, advanced purification processes, and extensive safety testing. These factors contribute to high production costs, which are often passed on to patients.

For many individuals, especially those from low-income or rural backgrounds, the cost of long-term immunoglobulin therapy can be prohibitive. The continued reliance on imported products in certain segments further increases costs due to logistics and import duties.

Addressing this challenge will require a combination of expanded domestic production, supportive pricing policies, and broader insurance coverage to ensure that life-saving therapies are accessible to those who need them most.

Regulatory and Quality Control Issues

The immunoglobulin industry operates under strict regulatory oversight, given the critical importance of product safety and efficacy. While robust regulation is essential, complex and time-consuming approval processes can delay product launches and increase compliance costs.

Maintaining consistent quality standards across different manufacturing facilities is another ongoing challenge, particularly in a market with diverse plasma sources and production practices. Any lapse in quality control can undermine patient trust and slow market growth.

Strengthening regulatory frameworks, improving inspection capacities, and aligning domestic standards with international benchmarks will be crucial for the sustainable development of the industry.

Market Segmentation: A Closer Look

The India immunoglobulin market is segmented across multiple dimensions to reflect its diverse applications and product formats.

By Product Type

IgG

IgA

IgM

IgE

IgD

By Mode of Delivery

Intravenous Mode of Delivery

Subcutaneous Mode of Delivery

By Application

Immunodeficiency Diseases

CIDP (Chronic Inflammatory Demyelinating Polyneuropathy)

Hypogammaglobulinemia

Congenital AIDS

Chronic Lymphocytic Leukemia

Myasthenia Gravis

Multifocal Motor Neuropathy

ITP (Immune Thrombocytopenic Purpura)

Kawasaki Disease

Others

By Region

East

West

North

South

This broad segmentation highlights the versatility of immunoglobulin therapies and their growing role across multiple therapeutic areas in India’s healthcare system.

Competitive Landscape: Key Players Driving Innovation

The Indian immunoglobulin market features a mix of global pharmaceutical giants and strong domestic players. Companies are being analyzed across four key dimensions: company overview, key persons, recent developments and strategies, and sales analysis.

Some of the prominent players include:

Baxter International Inc.

Grifols S.A.

Bayer Healthcare

Takeda Pharmaceutical Company Limited

PlasmaGen BioSciences Pvt. Ltd.

Reliance Life Sciences

Biocon Limited

Virchow Biotech

Bharat Serums and Vaccines

Biological E Limited

Intas Pharmaceuticals

Kedrion Biopharma

These companies are активно investing in capacity expansion, technology upgrades, strategic partnerships, and product portfolio diversification to strengthen their presence in the Indian market and meet rising demand.

Future Outlook: A Decade of Strong Momentum Ahead

With the market projected to grow from US$ 347 million in 2024 to US$ 1,220.6 million by 2033, the future of the India immunoglobulin market looks exceptionally promising. A 15.00% CAGR over the forecast period underscores the critical and expanding role of these therapies in modern medicine.

The coming years are likely to witness greater domestic manufacturing, improved affordability, wider insurance coverage, and stronger regulatory alignment with global standards. Together, these developments will not only support market growth but also ensure that more patients across India gain access to life-saving immunoglobulin treatments.

Final Thoughts

The rise of the immunoglobulin market in India is more than just a story of impressive numbers—it is a reflection of a healthcare system in transition. As awareness increases, diagnostics improve, and manufacturing capabilities expand, immunoglobulin therapy is set to become a cornerstone of treatment for millions of patients across the country.

While challenges such as high costs and regulatory complexities remain, the overall trajectory is unmistakably positive. With strong support from both the public and private sectors, India is well on its way to building a more resilient, accessible, and advanced immunotherapy ecosystem—one that promises better outcomes and a higher quality of life for patients in the years to come.

Comments

There are no comments for this story

Be the first to respond and start the conversation.