Non-GMO Food Market Size and Forecast 2025–2033: The Global Shift Toward Clean, Transparent Nutrition

Rising health awareness, clean-label demand, and sustainable farming are driving the global non-GMO food industry toward a US$ 476 billion future.

Introduction: A Market Shaped by Conscious Consumers

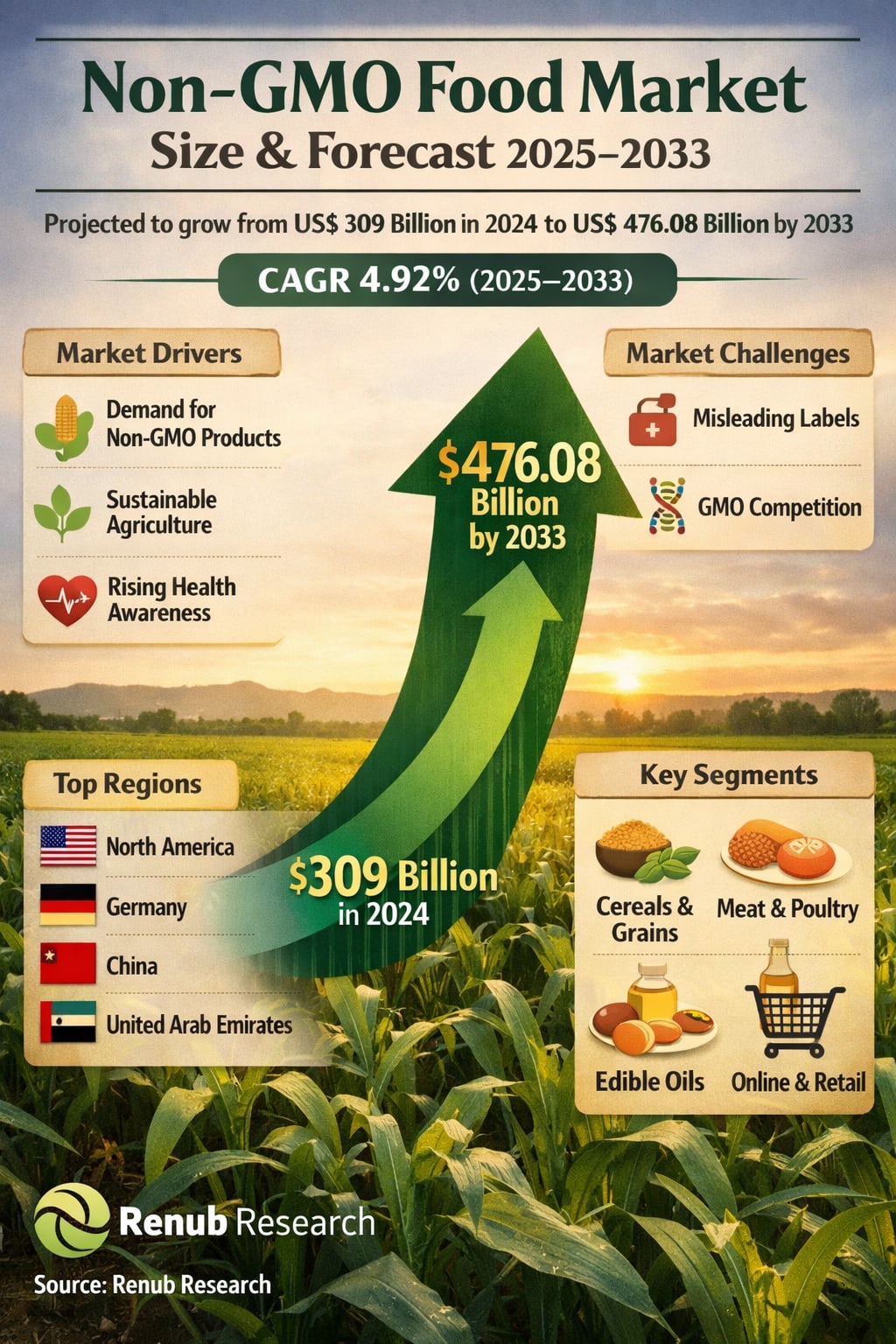

According to Renub Research’s latest publication, “Non-GMO Food Global Market Report by Product Type, Distribution Channel, Countries and Company Analysis, 2025–2033”, the Non-GMO Food Market is expected to reach US$ 476.08 billion by 2033, rising from US$ 309 billion in 2024, at a compound annual growth rate (CAGR) of 4.92% from 2025 to 2033.

This steady and resilient growth reflects a much bigger story unfolding in the global food industry. Consumers are no longer just buying food for taste or price—they are buying into values: transparency, sustainability, safety, and long-term health. The non-GMO movement sits right at the center of this transformation.

Across North America, Europe, and increasingly Asia-Pacific and the Middle East, shoppers are reading labels more carefully, questioning how food is grown, and demanding greater accountability from brands. For many, “non-GMO” has become a symbol of cleaner, more natural, and more trustworthy food production.

As food systems evolve and awareness continues to rise, the non-GMO food market is no longer a niche—it is becoming a mainstream pillar of the global food economy.

Global Non-GMO Food Industry Overview

The growing interest in health and well-being is one of the most powerful forces behind the expansion of the non-GMO food market. Consumers today are far more informed than in previous decades, and many are increasingly cautious about genetically modified organisms in their diets. As a result, non-GMO food is widely perceived as safer, more natural, and more environmentally responsible.

This perception is reinforced by the broader clean-label movement, which emphasizes simple ingredients, transparency in sourcing, and minimal processing. For many buyers, non-GMO certification acts as a trust signal, helping them make more confident purchasing decisions in a crowded and complex marketplace.

Food manufacturers have responded quickly to this shift. From cereals and grains to edible oils, meat products, beverages, and even baby food, the range of non-GMO-certified products continues to expand. A notable example is Danone SA’s launch of dairy and plant blend baby food made with non-GMO soy and other plant ingredients, highlighting how even specialized nutrition segments are embracing this trend.

At the same time, increased investment in research and development is helping companies improve product quality, diversify offerings, and optimize non-GMO supply chains. Combined with the rise of plant-based and allergen-sensitive diets, these factors are creating strong, long-term momentum for the global non-GMO food industry.

Key Factors Driving the Non-GMO Food Market Growth

1. Growing Interest in Natural and Organic Products

The demand for natural and organic food products has surged worldwide, and non-GMO foods are benefiting directly from this shift. Many consumers associate non-GMO labels with chemical-free farming, fewer artificial interventions, and better overall food quality.

As awareness grows about food sourcing and production methods, people are increasingly choosing products that align with their health goals and ethical values. Influencers, nutrition experts, and wellness advocates continue to promote whole, natural diets, reinforcing the appeal of non-GMO and organic alternatives.

This overlap between the organic and non-GMO segments has encouraged producers to invest more in certification, sustainable farming practices, and transparent supply chains—further strengthening market growth across both developed and emerging economies.

2. Expanding Retail and Increasing Availability

One of the most important enablers of market growth has been the rapid expansion of distribution channels. Today, non-GMO products are widely available across supermarkets, hypermarkets, specialty stores, convenience stores, and online platforms.

E-commerce, in particular, has played a transformative role. Online retail makes non-GMO products accessible to consumers beyond major urban centers and allows smaller or niche brands to reach a global audience. This wider availability not only boosts sales but also normalizes non-GMO products as everyday choices rather than premium exceptions.

Strong partnerships between manufacturers and retailers are also helping improve supply chain efficiency, product freshness, and shelf visibility—further supporting consistent market expansion.

3. Consumer Preference for Transparency in Food

Modern consumers want to know what is in their food, where it comes from, and how it is made. This demand for transparency has turned non-GMO certification into a powerful differentiator in competitive food markets.

Clear labeling, traceability systems, and third-party certifications help build trust and brand loyalty. As clean-label and minimally processed foods gain popularity, non-GMO products naturally fit into this narrative of honesty and openness.

To meet these expectations, many companies are investing in better quality control, stronger compliance systems, and more transparent communication strategies—creating a positive feedback loop that continues to strengthen the non-GMO market worldwide.

Challenges in the Non-GMO Food Market

1. False Claims and Misleading Labels

Despite strong growth, the market faces challenges related to mislabeling and unverified claims. Inconsistent or vague labeling can confuse consumers and undermine trust in genuinely certified non-GMO brands.

When some companies attempt to capitalize on the trend without proper certification, it damages overall market credibility. Regulatory bodies and certification organizations play a critical role in enforcing standards, but inconsistent enforcement across regions remains a concern.

Without stronger global harmonization of labeling rules, misleading claims will continue to pose a risk to long-term consumer confidence.

2. Competition from GMO Alternatives

GMO crops often offer higher yields, better pest resistance, and lower production costs, making them attractive to large-scale agricultural producers. This gives GMO-based food products a significant price and supply advantage in many markets.

In contrast, non-GMO farming typically involves higher costs and lower yields, which can limit scalability and price competitiveness. Established GMO supply chains and infrastructure in certain regions further intensify this challenge.

To stay competitive, non-GMO producers must continue emphasizing quality, sustainability, and consumer trust—factors that increasingly influence purchasing decisions beyond just price.

Non-GMO Food Market Overview by Regions

United States

The United States is one of the most mature and influential non-GMO food markets globally. Strong consumer awareness, strict labeling frameworks, and a thriving organic and clean-label movement have created a fertile environment for growth.

Food manufacturers and retailers continue to expand their non-GMO portfolios, particularly in plant-based, functional, and health-focused food categories. Support from environmental groups and consumer advocacy organizations further strengthens market momentum. The U.S. remains a trendsetter shaping global non-GMO food strategies.

Germany

Germany stands out as a European leader in the non-GMO segment. Consumer spending on products labeled “Ohne Gentechnik” (without genetic engineering) reached around €16 billion in 2022, reflecting strong and growing demand—especially for dairy, poultry, and egg products.

This growth mirrors Germany’s broader focus on sustainability, ethical consumption, and transparency in food production. Despite challenges such as higher production costs and complex supply chains, the country continues to set benchmarks for non-GMO standards in Europe.

China

China’s non-GMO food market is expanding as concerns about food safety, environmental impact, and health continue to rise. While genetically modified crops have historically played a role in supporting food security, consumer preferences are gradually shifting toward natural and clean-label alternatives.

Government initiatives supporting organic and sustainable agriculture are also contributing to this transition. However, challenges such as higher costs, limited supply, and the need for stronger certification systems remain. Even so, long-term growth prospects remain strong as consumer awareness deepens.

United Arab Emirates

In the UAE, rising demand for healthy, sustainable, and premium food products is driving interest in non-GMO options. Health-conscious consumers, combined with government efforts to support better food quality and security, are helping the market gain traction.

While challenges like higher prices and supply constraints persist, the trend toward clean-label and transparent food choices suggests continued growth in the coming years.

Market Segmentation

By Product Type

Cereals and Grains

Liquor

Meat and Poultry

Edible Oils

Others

By Distribution Channel

Supermarkets and Hypermarkets

Food Service

Convenience Stores

Online Stores

Others

By Region

North America:

United States, Canada

Europe:

France, Germany, Italy, Spain, United Kingdom, Belgium, Netherlands, Turkey

Asia Pacific:

China, Japan, India, Australia, South Korea, Thailand, Malaysia, Indonesia, New Zealand

Latin America:

Brazil, Mexico, Argentina

Middle East & Africa:

South Africa, Saudi Arabia, United Arab Emirates

Competitive Landscape

The global non-GMO food market features a strong mix of multinational corporations and specialized health-focused brands. Key players include:

Amy’s Kitchen, Inc.

Blue Diamond Growers

Organic Valley

The Hain Celestial Group, Inc.

Nestlé S.A.

The Kellogg’s Company

PepsiCo Inc.

Pernod Ricard

Clif Bar & Company

Danone SA

These companies are actively investing in product innovation, clean-label reformulations, transparent sourcing, and strategic partnerships to strengthen their positions in an increasingly competitive market.

Final Thoughts: A Market Built on Trust and Transparency

The global non-GMO food market’s rise from US$ 309 billion in 2024 to US$ 476.08 billion by 2033 reflects more than just changing food preferences—it signals a fundamental shift in how consumers relate to what they eat.

With a projected CAGR of 4.92% from 2025 to 2033, the industry is set to grow steadily, driven by health awareness, sustainability concerns, and the demand for transparency. While challenges such as pricing pressures and competition from GMO alternatives remain, the long-term outlook is clearly positive.

As trust, traceability, and clean-label values continue to shape the global food system, non-GMO products are no longer just an alternative—they are becoming a core part of the future of food.

Comments

There are no comments for this story

Be the first to respond and start the conversation.